Americans will be spending an average of $93.34 per person on food items for Fourth of July cookouts, barbecues and picnics this year, says Axios, citing a National Retail Federation survey. That’s a roughly 10% increase from last year, where consumers spent an average of $84.12. Yet, high prices aren’t stopping any celebrations: Around 87% of Americans say they’ll be celebrating the Fourth of July this year, with 65% of those planning a bbq or cookout.

- The most popular items on the July 4 bbq list include hamburgers (83%), hot dogs/pork or beef brats (76%), chicken (52%), and vegetables (45%).

- Firework sales are expected to increase by $100 million this year, according to the American Pyrotechnics Association.

By Jessica Hartogs, Editor at LinkedIn News

July 4 to see record spending on food for cookouts

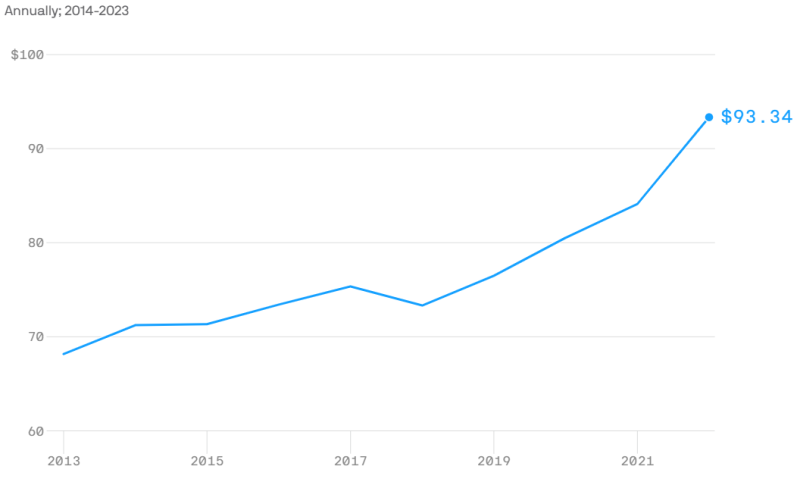

Average U.S. planned spending on July 4 food items, per person

Americans plan to spend an average of $93.34 per person on food items for Fourth of July cookouts, barbecues and picnics this year, according to an annual survey from the National Retail Federation.

By the numbers: That’s up from last year’s high of $84.12, as a larger number of people are now planning to host or attend celebrations this year, the trade group says.

- The roughly 10% increase is almost double food price inflation, which, according to the PCE price index out on Friday, was 5.8% as of May, suggesting higher intent to spend.

Zoom in: The top food categories consumers plan to buy are hamburgers (83%), hot dogs/pork or beef brats (76%), chicken (52%), and vegetables (45%).

Fed’s preferred inflation gauge cools alongside consumer spending slowdown

Shoppers in Union Square in San Francisco, Calif. Photo: David Paul Morris/Bloomberg via Getty Images

Some heat came off the U.S. economy in May, government data released on Friday showed: Consumer spending slowed, while a key inflation measure cooled.

By the numbers: The personal consumption expenditures price index, the Federal Reserve’s preferred measure of inflation, increased 3.8% from the same month a year ago — the lowest annual change in two years, and down from 4.3% registered the prior month.

- On a monthly basis, the index rose more slowly. In May it rose 0.1%, compared to 0.4% in the prior month.

- That means personal income, taking inflation into account, rose 0.3% (after a 0.1% decline in April).

Yes, but: The Core PCE price index, which excludes energy and food prices, barely budged — continuing a monthslong trend that signals price gains remain sticky across the economy.

- This measure rose 4.6% compared to the same month a year ago, down a tick from 4.7% in April.

- It rose 0.3% in May, slowing slightly from the 0.4% the prior month.

The big picture: The data also showed that consumers slowed spending last month, rising just 0.1%, down notably from the 0.6% pace in April.

- Consumers continued to splurge on services, with the biggest increases in spending coming from health care and travel. Meanwhile, they slowed purchases of goods like cars and trucks.

- Adjusted for inflation, consumer spending was flat in May (versus a 0.2% gain the prior month).

BY Hope King, author of Axios Closer