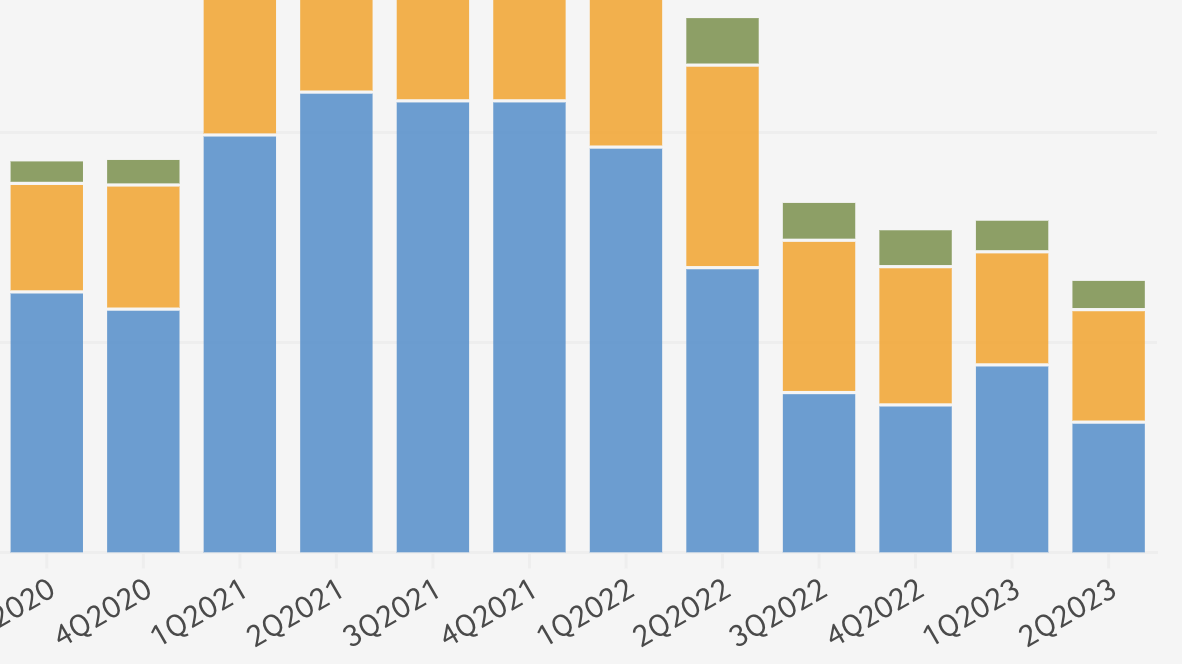

In the second quarter of 2023, a total of $31bn was invested in late-stage companies, down by 54.3% from the same period last year. This was sharper than the fall for both early stage companies (–44.5%) and angel-seed-stage start-ups (–38.8%).

“There’s a huge crunch in late-stage financing. It’s only going to get worse over the next 18 months,” said David Sacks, the general partner of Craft Ventures, on the All-In podcast which he co-hosts with fellow Silicon Valley entrepreneurs and investors Chamath Palihapitiya, Jason Calacanis and David Friedberg.

This decimation of VC investment comes despite hype around artificial intelligence (AI) companies, which attracted nearly a fifth of total global VC funding in the first half of 2023, according to Crunchbase.

Major funding rounds for AI companies have been led by corporate investors such as Microsoft, Google and Nvidia — the latter of which makes the chips used to train the large language models underpinning generative AI tools. Most recently, data management and analytics specialist Databricks agreed in June to acquire generative AI start-up MosaicML for $1.3bn.

“We are at the beginning of this,” says Gené Teare, the senior data editor of Crunchbase. “All of these [AI-based] technologies are going to impact almost every software and hardware company. I think there is a lot more funding to come into the sector.”

More on start-ups and venture capital:

- Tech bubble bursts? Investors retreat fuels layoffs spree

- European start-up scene reckons with the end of boom times

- Big tech layoffs barely touch pandemic-era hiring

Outside of AI, many of the roughly 1400 unicorns — or start-ups with a valuation of $1bn or more — are expected to see a significant mark down in their valuations or go out of business over the next 18 months. However, estimates of the extent of this decline vary.

Eli David, the CEO of Startup Blink, a research consultancy, tells fDi that he expects there will be a “mass extinction” event for companies with business models that do not work. He expects more than 50% of unicorns will no longer be unicorns when they raise new financing.

“They’re either going to shut down or be purchased in [mergers and acquisitions] with very low returns,” he says. “In the private markets, there is no transparency on prices. At some point, the cards are going to collapse.

“There was a massive bubble and it’s going to explode.”

Brad Gerstner, the CEO of Altimeter Capital, predicts that 100% of the 1400 unicorns at the end of 2022 “will likely do a down round”, which is when a start-up raises financing at a lower valuation than their previous round. He expects that 30–40% of companies valued above $1bn “do not have product market fit [and] will disappear”, while the “lion’s share of companies” will see their valuations marked down by at least 50%.

“The repricings have to occur,” Mr Gerstner told the All-In podcast, adding that were probably less than 5% of those roughly 1400 unicorns that he would “even want to own at the right price”.

Amid the significant pullback in VC funding, there are concerns that start-up ecosystems outside the major hubs will face an even sharper decline in the availability of capital. Mr David says that he expects “emerging start-up scenes to suffer more” as more limited availability of VC funding goes to safe bets in San Francisco or London.

BY Alex Irwin-Hunt