Apple closes above $3T in a first

Apple on Friday became the first company with a market value that closed above $3 trillion. The tech giant previously grazed the milestone during intraday trading in January 2022, but then closed shy of the mark. Apple shares have risen roughly 47% so far this year — adding about $940 billion in value. The tech sector has seen a flurry of renewed optimism around the potential of artificial intelligence, with the Nasdaq up about 30% and on track for its best first half of a year since the 1980s. Apple has also benefited from a rebound in its iPhone business.

- Apple is viewed by investors as a relatively safe stock in a time of global economic uncertainty, boosting its share price.

- No other company has ever reached $3 trillion at close or in intraday trading.

By Riva Gold, Editor at LinkedIn News

Apple Hits Historic $3 Trillion Milestone

-

The milestone follows a relentless stock rally this year

-

A high valuation and weaker analyst sentiment could be risks

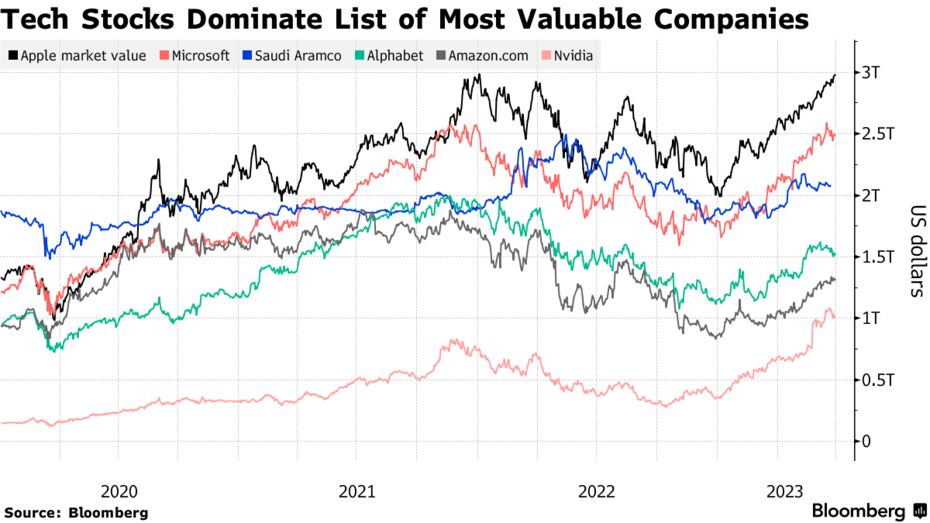

Apple Inc. made Wall Street history as the first company with a market value over $3 trillion, the latest sign of big tech’s seemingly unstoppable dominance in equity markets.

The iPhone maker gained 2.3% on Friday, adding to a rally that’s added more than $983 billion to its size this year and leaving it roughly a half-trillion dollars above the next-largest company. Apple’s ascent to the milestone helped the Nasdaq 100 Index to its best-ever first half ever, driving a broader stock rally that underscored the dominance of tech megacaps

The rally has caught many strategists off guard, leading some to question its viability as the economy faces potentially more Federal Reserve interest-rate hikes. However, investors remain excited about the growth potential of artificial intelligence, and they have also gravitated toward the kind of quality factors that Apple has in spades, including a strong balance sheet, durable revenue streams, and a robust competitive position.

“The reason Apple has outperformed for more than a decade isn’t because investors are being foolhardy, but because it is executing on a business strategy that works, its earnings plan is working, and its lock on the consumer is only getting stronger,” said Jonathan Curtis, director of portfolio management for Franklin Equity Group.

“The balance sheet is phenomenal, it pays a dividend it can continue to grow, it has an active repurchasing program, and a consumer staples-esque platform business, all powered by a device people look at four hours a day,” Curtis said.

In a sign of Wall Street’s ongoing optimism about the stock, Citi on Thursday began coverage of Apple with a buy rating, writing that its ability to continue expanding margins was underappreciated. It sees additional upside of about 30% for the stock, a target that would take Apple close to a $4 trillion valuation.